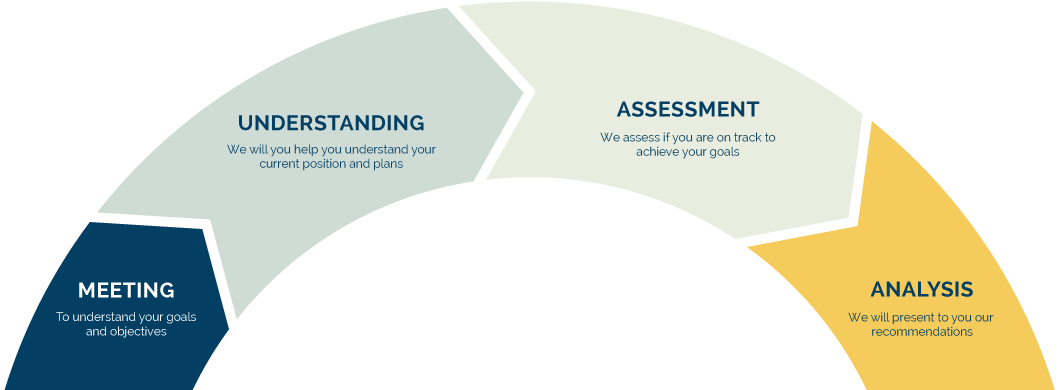

Take Your Investing to the Next Level

Whether you are a beginner, an expert or somewhere in-between, we can help you make the most of your money.

We help you manage assets

Creating wealth by providing returns on investments, we exist because you are there.

Corporate and finance solutions

By fulfilling our purpose, we can positively transform lives and make a real impact in the world.